W systemie KSeF raz wysłana faktura staje się trwałym elementem rejestru (pozostaje w systemie przez 10 lat). Jeśli zatem na dokumencie pojawi się błędna cena, zła ilość towaru lub niewłaściwy odbiorca, jedynym sposobem naprawy błędu jest wystawienie ustrukturyzowanej faktury korygującej. System nie pozwala na edycję czy „anulowanie” raz zatwierdzonego dokumentu.

Jak księgować korekty?

Zasady ujmowania faktur korygujących zależą od ich rodzaju oraz trybu wystawienia:

- Faktury in minus (w KSeF): Rozliczamy je w deklaracji za okres, w którym zostały wystawione.

- Faktury in plus: ujmuje się je w okresie, w którym powstała przyczyna korekty (zasad pozostają

bez zmian). - Faktury in minus (poza KSeF): W 2026 roku mogą się jeszcze pojawiać faktury

nieustrukturyzowane; ujmuje się je w okresie otrzymania potwierdzenia odbioru przez

nabywcę. - Tryby awaryjne i offline: Faktury te ujmuje się w okresie, w którym zostały przesłane do KSeF.

Faktura korygującej a schemat FA(3)

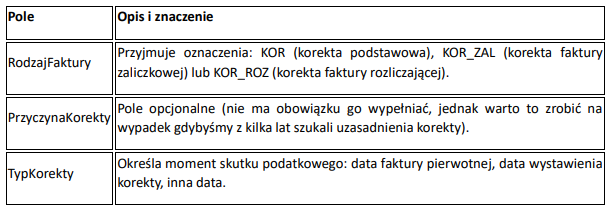

Faktura korygująca w KSeF posiada specyficzne pola, które pozwalają systemowi zrozumieć charakter wprowadzanej zmiany:

Trzy metody prezentacji zmian

W KSeF przedsiębiorca ma do wyboru trzy sposoby pokazania różnic między oryginałem a korektą.

- Metoda różnicowa: Najprostsza forma, w której wpisujemy jedynie różnicę (np. -500 zł netto), bez pokazywania stanu początkowego.

- Metoda ze znacznikiem „StanPrzed”: dobrze ją stosować przy błędnych stawkach VAT. Jeden

wiersz zawiera błędne dane (oznaczone jako StanPrzed), a drugi prawidłowe dane po korekcie.

Wartości StanPrzed są traktowane przez system z przeciwnym znakiem, co zapobiega

błędnemu sumowaniu. - odwrócenie pozycji: Uproszczona wersja metody 2 – prezentujemy dane pierwotne z minusem,

a następnie wpisujemy dane prawidłowe, bez używania znacznika.

Błędny NIP nabywcy

W KSeF nie można edytować NIP-u na wysłanej fakturze. Jeżeli wpisany NIP jest nieprawidłowy musimy w pierwszej kolejności wystawić korektę “do zera” dla pierwotnego (błędnego) nabywcy, a następnie możemy dopiero wystawić nową z prawidłowymi danymi.

Korekty z rabatów

System KSeF pozwala na wystawienie jednej faktury korygującej dla wielu faktur pierwotnych. Przy rabatach zbiorczych można stosować uproszczenia w opisach i liczbie pozycji, co znacznie redukuje formalności.

Dobra praktyka: Najpierw projekt, potem KSeF

Ze względu na brak możliwości łatwego usunięcia e-faktury, warto rozważyć przesyłanie klientom dokumentów projektów faktur do akceptacji. Dopiero po potwierdzeniu poprawności danych przez kontrahenta wystawiamy fakturę ustrukturyzowaną w systemie. Pozwoli to uniknąć niepotrzebnej pracy przy korektach.

Niniejszy artykuł ma charakter informacyjny i nie jest to porada prawna.

Stan prawny na dzień 12 stycznia 2026 r.

Autor/Redaktor cyklu: