Tak, jak informowaliśmy w naszym cyklu Podatkowe to i owo, 2025 rok będzie pierwszym, w którym niektórzy podatnicy CIT zapłacą podatek minimalny. Stawka podatku minimalnego wyniesie 10%. Ze względu na duże zainteresowanie tym tematem przedstawiamy szczegółowe zasady obliczania tego podatku.

Podatnik podatku

Podatnikiem minimalny zapłacą podatnicy CIT, którzy w roku podatkowym ponieśli stratę, lub udział dochodu w ich przychodzie był niższy, niż 2%. Wyłączenie spod opodatkowania podatkiem minimalnym przedstawiamy na przygotowanym grafie [link]

Na potrzeby określenia straty oraz udziału dochodów w przychodach, nie uwzględnia się jednak wszystkich zdarzeń gospodarczych. W celu ustalenia dla potrzeby podatku minimalnego, czy spółka będzie, czy nie będzie zobowiązana do jego zapłaty w kosztach i przychodach nie uwzględnia się:

1) zaliczonych do kosztów uzyskania przychodów, w tym poprzez odpisy amortyzacyjne, kosztów wynikających z nabycia, wytworzenia lub ulepszenia środków trwałych lub wykorzystywania środków trwałych na podstawie umowy leasingu, jeżeli odpisów amortyzacyjnych dokonuje korzystający;

2) przychodów oraz kosztów uzyskania przychodów bezpośrednio lub pośrednio związanych z tymi przychodami odpowiednio osiągniętych albo poniesionych w związku z transakcją, jeżeli:

a) cena lub sposób określenia ceny przedmiotu transakcji wynika z przepisów ustaw lub wydanych na ich podstawie aktów normatywnych oraz

b) podatnik w roku podatkowym poniósł stratę ze źródła przychodów innych niż z zysków kapitałowych z transakcji, o której mowa w lit. a, albo osiągnął udział dochodów ze źródła przychodów innych niż z zysków kapitałowych w przychodach innych niż z zysków kapitałowych wynikający z takiej transakcji w wysokości nie większej niż 2%, przy czym obliczenia straty i udziału dochodów w przychodach dokonuje się odrębnie dla transakcji tego samego rodzaju;

3) zaliczonych do kosztów uzyskania przychodów opłat ustalonych w umowie leasingu;

4) przychodów oraz kosztów uzyskania przychodów bezpośrednio związanych z tymi przychodami z tytułu zbycia wierzytelności na rzecz instytucji finansowej prowadzącej działalność faktoringową;

5) wzrostu kosztów uzyskania przychodów z tytułu zakupu energii elektrycznej, cieplnej lub gazu przewodowego za rok, za który należny podatek minimalny w porównaniu z rokiem poprzednim;

6) zapłaconych przez podmiot do tego obowiązany kwot:

a) podatku akcyzowego,

b) podatku od sprzedaży detalicznej,

c) podatku od gier,

d) opłaty paliwowej,

e) opłaty emisyjnej;

7) zaliczonej odpowiednio do przychodów lub kosztów uzyskania przychodów kwoty podatku akcyzowego zawartego w cenie wyrobów akcyzowych kupowanych i sprzedanych przez podatnika dokonującego obrotu tymi wyrobami;

8) 20% kosztów uzyskania przychodów z tytułu wynagrodzeń za pracę, zasiłków pieniężnych z ubezpieczenia społecznego wypłacanego przez pracodawcę, wpłat na pracownicze plany kapitałowe dokonywanych przez pracodawcę, składek na ubezpieczenie społeczne finansowane przez pracodawcę.

Podstawa opodatkowania

Jeżeli już ustalimy, że na potrzeby podatku minimalnego spółka poniosła stratę, lub udział jej dochodu w przychodzie był niższy, niż 2%, musimy obliczyć podstawę, od której naliczony będzie podatek.

Podstawę opodatkowania podatkiem minimalnym stanowi:

1) kwota odpowiadająca 1,5% wartości przychodów ze źródła przychodów innych niż z zysków kapitałowych osiągniętych przez podatnika w roku podatkowym oraz;

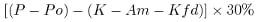

2) poniesionych na rzecz podmiotów powiązanych, z wyjątkiem gdy powiązania wynikają wyłącznie z powiązania ze Skarbem Państwa lub jednostkami samorządu terytorialnego lub ich związkami, kosztów finansowania dłużnego, w takiej części, w jakiej koszty te przewyższają kwotę obliczoną według następującego wzoru:

oraz

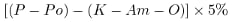

3) kosztów:

a) usług doradczych, badania rynku, usług reklamowych, zarządzania i kontroli, przetwarzania danych, ubezpieczeń, gwarancji i poręczeń oraz świadczeń o podobnym charakterze,

b) wszelkiego rodzaju opłat i należności za korzystanie lub prawo do korzystania z autorskich praw majątkowych i praw pokrewnych, licencji, prawa własności przemysłowej, know-how,

c) przeniesienia ryzyka niewypłacalności dłużnika z tytułu pożyczek, innych niż udzielonych przez banki i spółdzielcze kasy oszczędnościowo-kredytowe, w tym w ramach zobowiązań wynikających z pochodnych instrumentów finansowych oraz świadczeń o podobnym charakterze

– poniesionych bezpośrednio lub pośrednio na rzecz podmiotów powiązanych lub podmiotów mających miejsce zamieszkania, siedzibę lub zarząd na terytorium lub w kraju stosującym szkodliwą konkurencję podatkową w części, w jakiej koszty te łącznie w roku podatkowym przekraczają o 3 000 000 zł kwotę obliczoną według następującego wzoru:

Poszczególne symbole oznaczają:

P – zsumowaną wartość przychodów ze wszystkich źródeł przychodów, z których dochody podlegają opodatkowaniu podatkiem dochodowym,

Po – przychody o charakterze odsetkowym

K – sumę kosztów uzyskania przychodów bez wyłączenia kosztów finansowania dłużnego

Am – odpisy amortyzacyjne zaliczone w roku podatkowym do kosztów uzyskania przychodów

Kfd – zaliczone w roku podatkowym do kosztów uzyskania przychodów koszty finansowania dłużnego nieuwzględnione w wartości początkowej środków trwałych oraz wartości niematerialnych i prawnych, przed dokonaniem pomniejszeń kosztów finansowania dłużnego

O – zaliczone w roku podatkowym do kosztów uzyskania przychodów odsetki, bez pomniejszeń kosztów finansowania dłużnego

Podstawa opodatkowania podlega pomniejszeniu o:

1) wartość odliczeń zmniejszających w roku podatkowym podstawę opodatkowania, z wyłączeniem pomniejszeń o ulgę na złe długi;

2) przychody, które są uwzględniane przy obliczaniu dochodu zwolnionego z podatku u podatników prowadzących działalność w specjalnych strefach ekonomicznych oraz z działalności gospodarczej osiągnięte z realizacji nowej inwestycji określonej w decyzji o wsparciu u podatnika, który w roku podatkowym korzysta ze zwolnień podatkowych na działalność w SSE oraz na nowe inwestycje;

3) przychody, których nie uwzględnia się do określenia straty i udziału dochodu w przychodach spółki na potrzeby podatku dochodowego.

Podatek

Od tak określonej podstawy należny podatek wynosi 10%.

Niniejszy artykuł ma charakter informacyjny i nie jest to porada prawna.

Stan prawny na dzień 15 grudnia 2024 r.

autor/redaktor cyklu:Nasze artykuły i alerty prawne możesz otrzymywać jako pierwszy, prosto na swoją skrzynkę mailową! Zapisz się do newslettera klikając w link lub skontaktuj się z nami pod adresem mailowym social@kglegal.pl, aby spersonalizować wysyłane treści.